In the latest, AMSC suffered clear defeats in 2 main jurisdictions in China, Beijing and Hainan, where both jurisdictions dismissed AMSC's copyright complaints. http://www.windpowermonthly.com/article/1350760/sinovel-claims-court-win-amsc In April the Beijing Intermediate People's Court dismissed another AMSC software copyright infringment case against Sinovel. AMSC made … [Read more...] about Update on AMSC v. Sinovel “IP theft” lawsuits

trade

Creating Central Eurasia – a vision for collaboration between the Silk Road & Eurasian Union projects

I want to share a GREAT analysis from the Valdai Club (see links below), outlining the opportunities for the PRC & Russia to jointly promote development and stability in Central Asia, by integrating the Silk Road Economic Belt (SREB) & Eurasian Union initiatives. I find it an insightful counter-narrative to the mainstream (mostly western) rhetoric of China & Russia … [Read more...] about Creating Central Eurasia – a vision for collaboration between the Silk Road & Eurasian Union projects

5 Popular Misconceptions about the Sino-Russian Gas Deal

The conclusion of a 30-year, 38 BCM/year Sino-Russian gas deal has gotten considerable attention in the media recently. Not surprisingly, much of the coverage - especially in the western media - was emotionally charged, given that Putin's visit to China & the deal signing coincided with the unfolding crisis in Ukraine. There was no shortage of rhetoric about Putin "making … [Read more...] about 5 Popular Misconceptions about the Sino-Russian Gas Deal

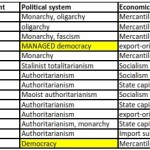

Yet another myth about democracy: “democracy+capitalism = prosperity”

When I wrote my first commentary on this blog, I outlined three common myths that people frequently believe without question when they think about democratic governance. Obviously, an idea as blindly and fervently worshiped as 'democracy' will have far more than just three myths associated with it. I continue my exploration of this ideology by discussing another myth that is … [Read more...] about Yet another myth about democracy: “democracy+capitalism = prosperity”

New Internet Economy Puts Dent In “Boycott China”

I have long maintained that boycotts rarely work well as a tool of political protest. Even when mobilized as a collective national action like a trade embargo, history has not shown much effectiveness in causing political change, other than merely increasing bitterness (like the Embargo against Cuba). Against a much larger target, with even broader scope, such as "boycott … [Read more...] about New Internet Economy Puts Dent In “Boycott China”